After two years of consistent growth in the Bury property market, with record prices and a high volume of sales, it looks like a decline is now on the horizon.

For many, this won’t be unexpected, with inflation rising and the energy crisis looming. But, for those thinking of selling their property and taking advantage of some of the highest prices on record, the window of opportunity might be closing.

Why have prices been so high?

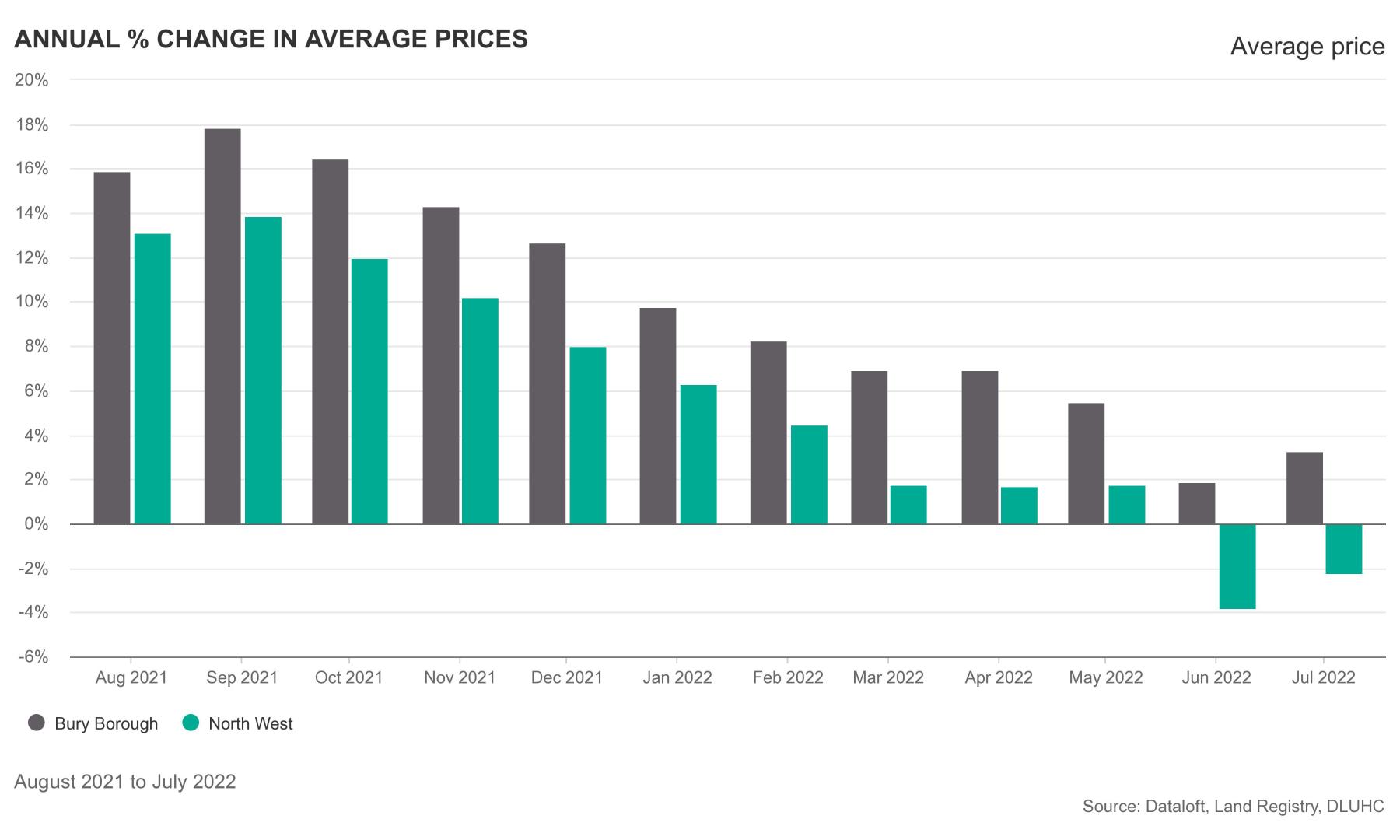

When the first lockdown was announced in March 2020, property prices were expected to fall. However, the opposite happened, and at their peak in September 2021, annual prices were up 17.88% across the Bury Borough, outperforming the North West average at 13.88%.

Quite simply, a lack of stock compared to the level of demand has meant that competition on the same houses inflated prices beyond their market values. Interest rates have been at historic lows, meaning people can borrow more than they perhaps once could.

Properties were being listed one day and had dozens of enquiries the next. It was not uncommon (and still isn't in some cases) to have 15-20 viewings on the same houses, usually leading to multiple offers.

I have spoken to many buyers over the last couple of years who have reported that they have offered on several homes but missed out due to being outbid. And our buyer registers have never been as big with so many people wanting to be alerted as soon as new properties hit the market.

So, what has changed?

As the cost of living has started to rise and there is a lack of clarity surrounding energy bills, many people have now decided to wait and see what happens. The base rate of interest has also risen – up to 1.75% in August 2022 from a record low of 0.1% in December 2021.

Our Mortgage Advisor, Steve Ellis, reported that banks are changing their rates daily, and it is a race to get them locked in before they increase.

Uncertainty generally makes people nervous, and we can see that the number of active buyers in the market is starting to drop.

Not all doom and gloom.

However, despite this, there are still many buyers out there. Yes, it is quieter than it was, but it was busier than it ever has been – probably unrealistically so if we’re honest. So, where there once might have been 10, 15 or even 20 people lined up to see your home (there still are in some cases), it might now only be a handful.

But, sometimes, quality over quantity can be better, particularly for certain homes. Your estate agent will have to work harder to get people through the door and negotiate that premium price but you can still get it!

There is still a buoyant market across the Bury Borough, and it continues to outperform the North West average, as this table below shows:

Broken down, the latest data available (July) is as follows:

- Bury +2.86%

- Radcliffe +3.88%

- Prestwich + 3.97%

- Ramsbottom - 1.67%

- Whitefield +3.73%

As you can see, Ramsbottom has already seen a drop (its third consecutive month).

Make sure you have a plan B!

It is difficult to say what is going to happen. But, if the North West average has started to fall, it is almost inevitable that the Bury area will too. So, if you are considering selling your home, or you’re on the market right now and struggling to sell, it’s more important than ever to consider your worst-case scenario or your plan B!

What if interest in your home is limited? What if prices were to fall 5% or even 10%? The last recession saw house prices drop 25% - more in some areas – what if this was to happen again?

Don’t forget, if your house price falls and you are also buying, the one you are looking to purchase will likely drop in value too. If you’re moving up, this could work in your favour as the percentage decrease of the higher amount will mean you could save more.

You may have to take a drop on your own home, but could you renegotiate your onward purchase price to make it fit? It might be that you need to change your mortgage product. There are plenty of options to be considered, but it is essential that you understand what they are should things change quickly.

Should I sell or wait?

This is one of the most common questions we get, and the answer is usually the same; it all depends on your circumstances. It’s important to understand why it is that you are moving. What do you need to get from your move? Is it for more space? Do you need to be nearer schools for your children? Is it purely financial?

I am going through the process myself and have had the same conversations. I could wait to see if property prices fall or interest rates decrease. But, in reality, I need more space, and nothing will change that. It is likely to be a move for the long term, so a few ups and downs aren’t really going to make a difference.

I would say that if you are looking to maximise value and sell at the top, I think we are very close to that as prices have already started dropping everywhere else. They likely will be in our area too, so if you are in that position, I would try and sell as soon as possible.

The next few years are certainly going to be interesting. If you need any help or advice, please do get in touch.

By

By

By

By

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link